The IRS Form 2290 is used to:

Make use of our 2290 Form instructions and complete your Form 2290

error-free.

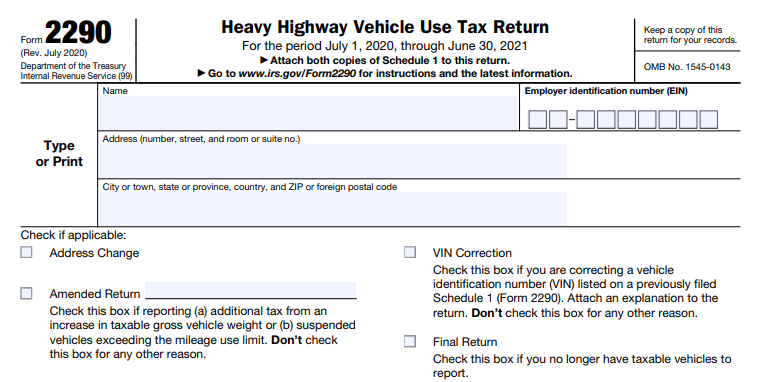

Before you start filing Form 2290, make sure you have the following information ready. These basic details are required to complete Form 2290.

Enter these basic details to get started.

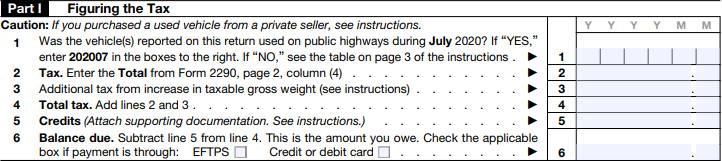

Page 2 of Form 2290 is for calculating your tax amount.

Based on your vehicle’s First Used Month, type and category, calculate the taxes and enter the amount on columns a and b. Also, enter the number of vehicles under

each category.

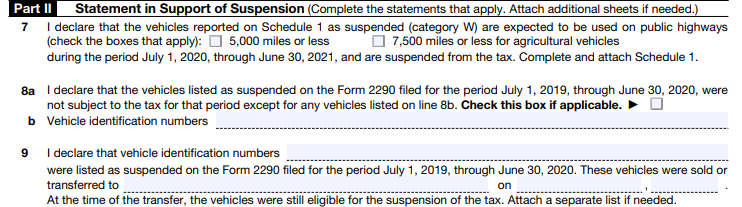

Form 2290 Schedule 1 is proof that you filed Form 2290 and it should be submitted along with your Form 2290. Your Schedule 1 will be stamped and returned to you after approval.

Enter your business details, including name, EIN, address, and the vehicle’s month of first use.

Form 2290 taxes in any of the following ways.

Visit

https://www.expresstrucktax.com/hvut/irs-2290-hvut-payment/

to know more about

IRS 2290 payments

Filing Form 2290 online is more convenient than paper filing.